Master the Three Types of Income & Unlock Financial Freedom

Learn How To Separate Your Income From Your Time!

Maximize Your Wealth: Learn the Secrets of Income Leveraging

Welcome to the world of financial empowerment! Have you ever wondered why some people seem to have a knack for growing their wealth effortlessly? The answer lies in understanding and leveraging different types of income.

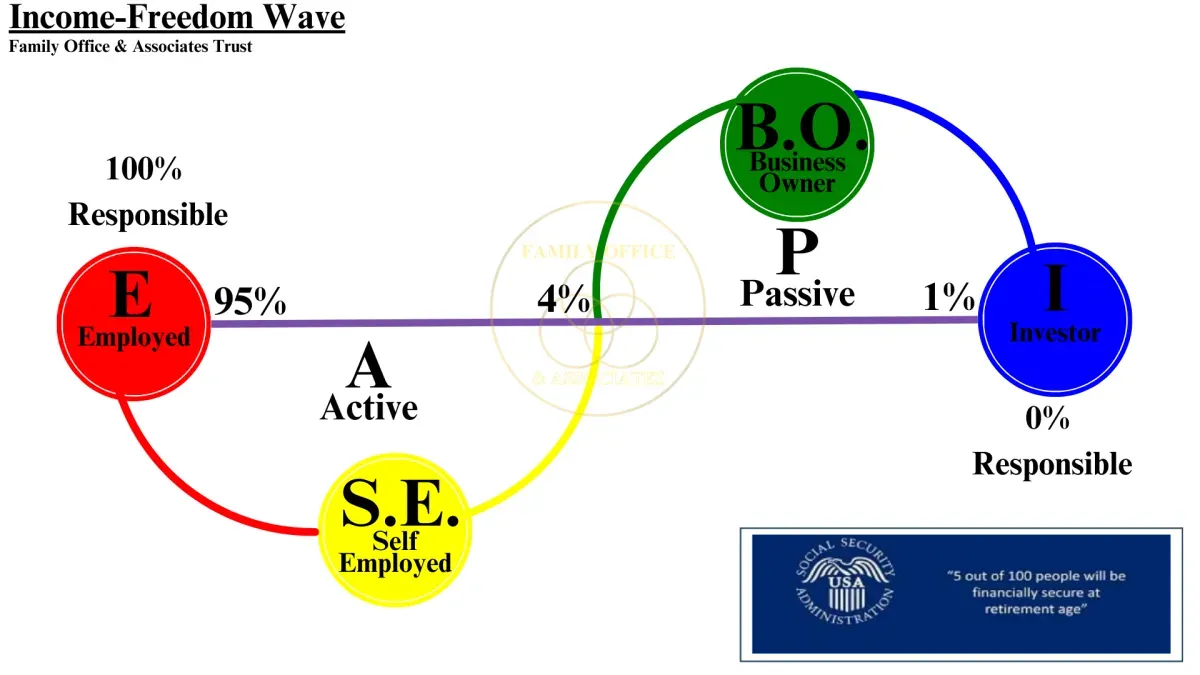

According to the IRS, there are only three income streams: earned, portfolio, and passive. Earned income, the type most people are familiar with, comes from traditional employment but is also the most heavily taxed, sometimes as high as 50% in the U.S. By expanding your financial knowledge and exploring other income types, you can unlock new avenues for wealth creation.

The traditional financial advice of solely relying on earned income is being challenged here. Why settle for the highest taxed income when there are more efficient ways to grow your wealth? Enter portfolio and passive income.

Portfolio income, derived from investments like stocks or real estate, faces lower taxation, around 20%. Even more intriguing is passive income, which can potentially enjoy the lowest tax rates, sometimes even 0%, with smart management. This shift from earned to a mix of portfolio and passive income can significantly enhance your financial health, allowing your hard-earned money to work smarter, not harder.

But how do you start this transformative journey? Education is key. Understanding the nuances of different income types and their tax implications can open doors to new financial strategies. The tax system, while complex, rewards those who navigate it intelligently, favoring entrepreneurs and investors.

By adopting the mindset of a business owner or an investor, you align yourself with these incentives, paving the way for not just wealth accumulation but also efficient tax planning. Embrace this knowledge, and you'll be on your way to a more prosperous financial future.

Our Comprehensive Wealth Plan, The Real Wealth Blueprint helps you better understand and start capitalizing on different income streams, all while encouraging you to think beyond traditional financial norms and embrace a more strategic approach to wealth building.

"If you give a man a fish, you feed him for a day. If you teach a man to fish, you feed him for a lifetime" Lao Tzu

Learn The Secrets of the Wealthy For Yourself!

The 3 Types of Income

What Would The Rockefellers Do

Create Your Own Cashflow Bank

The 3 Main Stages Of Our Comprehensive Wealth Blueprint

1. Financial Control

2. Cash Investing

3. Cashflow Investing

Personal Credit Blueprint

How To: 800 Credit Score In 45-Days!

How To Eliminate Your Debt - Part One

How To Eliminate Your Debt - Part Two

Business Credit Blueprint

How To: Get 100k In Business Funding

Your EIN Is All You Need!

How To Write-Off Almost Anything!

Asset Protection Blueprint

The ULTIMATE Asset Protection Setup

How To: Protect Your Income & Assets

A Blueprint for Zero Tax!

Savvy Investing Blueprint

How To: Seller Financing & Wraps

How To: Free Land Trust Master Class

Investing Through Trusts Overview

Family Banking Blueprint

Don't Build Net Worth, BUY IT!

How To: Whole Life Insurance Strategy

Create Your Own Bank With Life Insurance

Our Comprehensive Wealth Plan - The Blueprint

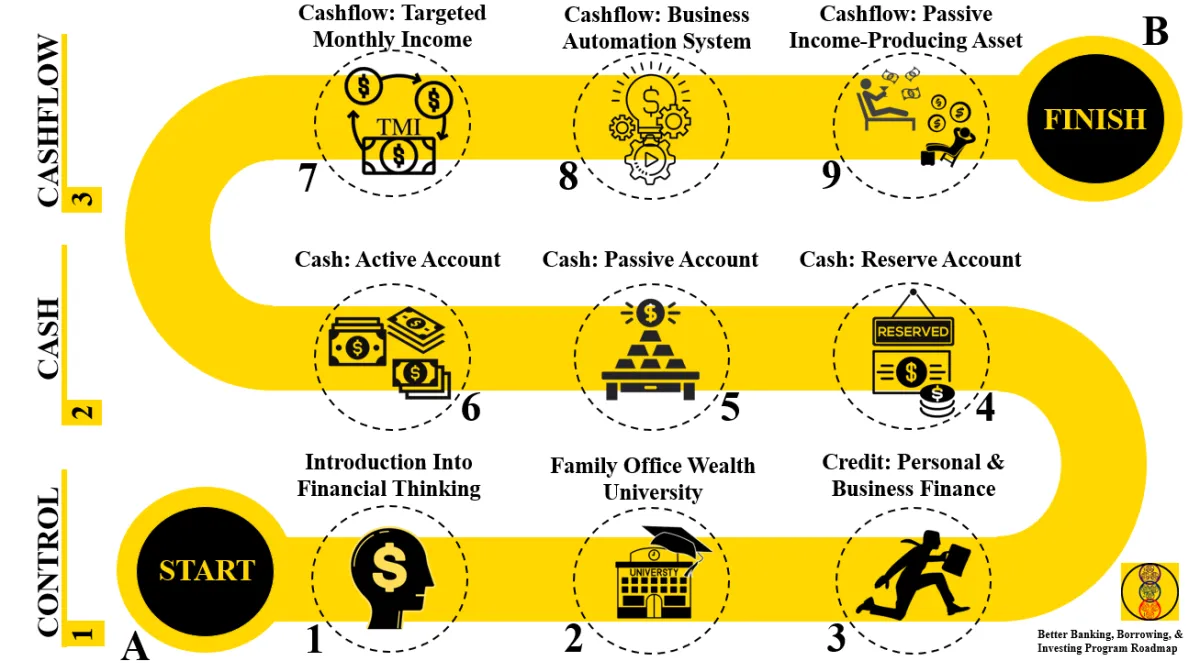

Better Banking, Borrowing, & Investing RoadMap

Our Comprehensive Wealth Plan has 3 Major stages or levels and 9 Key Steps, to what we call, Real Wealth! This plan walks you from where you are now, to where you want to be in the most efficient and effective way possible.

Learn how to build and protect your wealth today!

The 3 Stages To Real Wealth

Financial Control Blueprint

Cash Investing Blueprint

Cashflow Investing Blueprint