Federal Reserve Probability of Rate Cut

Federal Reserve's Anticipated Rate Cuts: What Investors Need to Know

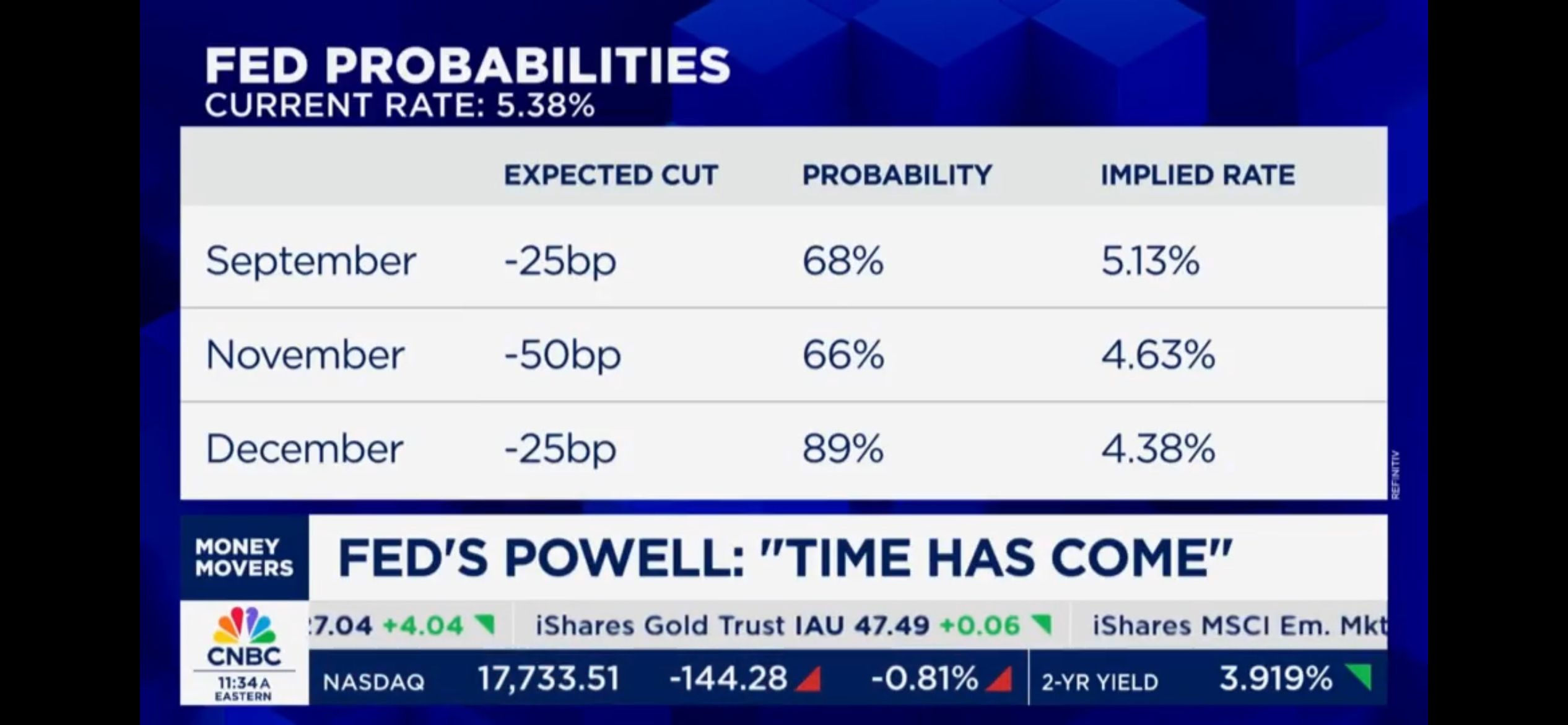

In a significant development for financial markets, the Federal Reserve is expected to implement a series of interest rate cuts in the coming months. The current interest rate stands at 5.38%, but projections indicate potential reductions that could reshape the economic landscape.

Projected Rate Cuts:

- September: A 25 basis point (bp) cut is anticipated with a 68% probability, bringing the implied rate to 5.13%.

- November: A more substantial 50 bp cut is expected with a 66% probability, leading to an implied rate of 4.63%.

- December: Another 25 bp cut is highly probable at 89%, resulting in an implied rate of 4.38%.

Market Reactions: The NASDAQ index has experienced a decline of 144.28 points, or 0.81%, reflecting investor adjustments to the anticipated rate changes. Meanwhile, the 2-year yield is at 3.919%, indicating shifts in bond market expectations.

Investment Implications: Federal Reserve Chair Jerome Powell's statement, "Time has come," suggests a pivotal moment in monetary policy. For investors, these potential rate cuts could mean:

- Lower Borrowing Costs: Reduced rates may stimulate economic activity by making borrowing cheaper for businesses and consumers.

- Portfolio Adjustments: Investors might consider reallocating assets, focusing on sectors like banking, real estate, and consumer goods that could benefit from lower rates.

- Safe-Haven Assets: The slight increase in the iShares Gold Trust (IAU) suggests a possible move towards gold as a protective measure against market volatility. As the Federal Reserve navigates these changes, investors should stay informed and consider strategic adjustments to their portfolios to capitalize on the evolving economic environment.

Here's a summary:

1. Current Rate: The current interest rate is 5.38%.

2. Expected Rate Cuts:

- September: A 25 basis point (bp) cut is expected with a 68% probability, leading to an implied rate of 5.13%.

- November: A 50 bp cut is expected with a 66% probability, leading to an implied rate of 4.63%.

- December: A 25 bp cut is expected with an 89% probability, leading to an implied rate of 4.38%.

3. Market Data: - The NASDAQ index is down by 144.28 points, a decrease of 0.81%. - The 2-year yield is at 3.919%. - iShares Gold Trust (IAU) is slightly up by 0.06. - iShares MSCI Emerging Markets is also mentioned.

4. Statement from Fed's Powell: "Time has come," suggesting a significant decision or change in policy is imminent. ### Implications for Investors: - Interest Rate Cuts: The high probabilities of rate cuts suggest that the Federal Reserve is likely to lower interest rates in the coming months. This could lead to lower borrowing costs, potentially stimulating economic activity. -

Market Reaction: The decrease in the NASDAQ index might indicate investor concerns or adjustments in response to the expected rate changes. - Investment Strategy: Investors might consider adjusting their portfolios to account for potential rate cuts, which could affect sectors like banking, real estate, and consumer goods.

Additionally, the slight increase in gold trust value suggests a possible shift towards safe-haven assets. Overall, the information suggests a cautious but potentially favorable environment for investments sensitive to interest rate changes.